Class-9 : Book Keeping & Accountancy - Unit-I : Introduction To Book-keeping & Accountancy

Unit I

Introduction to Book-keeping and Accountancy

To download Unit I (Introduction to Book-keeping and Accountancy) notes in PDF for future use please click on the link below.

Theory - CLICK HERE

Note : All the copyright of this PDF content belongs to NBSEguideonline. It is available to all NBSEguideonline users without any subscription.

*****

VERY SHORT ANSWER TYPE QUESTIONS

1. What do you mean by Book Keeping ?

Ans : Book keeping is a combination of two words i.e, 'BOOK' & 'Keeping' where 'Book' means maintenance of business & 'Keeping' means to keep the book in a systematic manner and updated with the complete records of all the transactions.

2. Define Book Keeping.

Ans : According to Nortch Cott - “Book-keeping is an art of recording in the books of accounts the monetary aspects of commercial or financial transactions."

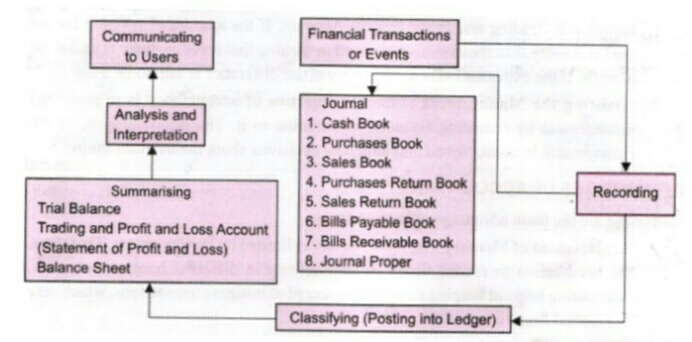

3. Draw the process of Book keeping.

Ans : The process of Book keeping is draw below :

4. Mention the objectives of Book Keeping.

Ans : Following are the objectives of Book Keeping :

I. To Show permanent record of business.

II. To know the profit & loss of business.

III. To Know the financial position of the business.

5. Define Accountancy.

Ans : Accountancy refers to a systematic knowledge of accounting. It involves the procedural aspects of preparation of books of accounts, summarisation & communication of accounting information to interested parties.

6. Write two advantages of accountancy.

Ans : Two advantages of accountancy are -

I. Replacement of memory

II. Helpful in planning

SHORT ANSWER TYPE QUESTIONS

1. Write four characteristics of Book keeping.

Ans : Following are the four characteristics of Book keeping.

I. It is the initial step for recording the business transaction.

II. Every transaction is properly analysed before recording.

III. It provides enough information about the position of various accounts.

IV. The transactions recorded should be capable of being expressed into monetary terms.

2. Explain the process of Book keeping.

Ans : The process of Book Keeping are explained as follows :

I. Identification of transactions - Only those transactions are recorded in books which can be expressed in terms of money. Non monetary transactions are ignored.

II. Recording of transactions - In this step, transactions are recorded in journal or subsidiary books, cashbook, etc.

III. Ledger posting - After recording the transactions in journal, these entries are posted into ledger accounts.

IV. Balancing of Ledger accounts - After periodic intervals, ledger accounts are balanced by finding the difference between debit side & credit side of an account.

V. Preparation of Trial balance - This is the last step in the process of Book keeping. Trial balance is prepared by taking the ledger account's balances to check the arithmetical accuracy of the book.

3. Why Book keeping is needed ?

Ans : Book keeping is needed for following points :

I. Needed for financial information - Financial information of the business is needed for preparing policies, budgets, etc. This is possible only when proper records are maintained.

II. Limited Human Memory - Now-a-days, volume of transactions is so large, a human memory cannot absorb each & every transaction. So, Book keeping helps to store the information in a systematic way.

III. Information needed of various users - Book keeping provides a relevant information to the users such as investors, owners, creditors, bankers, etc.

IV. Provides Evidence - The proper and systematic records of the financial transactions act as evidence in the court of law.

V. Preparation of Financial statements - Book keeping provides necessary data for preparing financial statements.

4. Write three objectives of Book keeping.

Ans: Following are the three objectives of Book keeping :

I. To show permanent record of business - The main objective is to keep complete record of business transactions on the basis of accounting rules, principles, concepts, etc.

II. To know the profit and loss of business - The second main objective is to ascertain the profit or loss of the business at the end of a financial year.

III. To know the financial position of the business - After ascertaining the net profit or loss, Balance sheet is prepared. The main purpose of Balance sheet is to ascertain the true financial position of the business at a particular point of time.

5. What do you mean by Accountancy ? Explain its objectives.

Ans: Accountancy refers to a systematic body of knowledge prescribing certain rules or principles or techniques to be observed while recording, classifying and summarising of transactions.

According to Kohler, 'accountancy refers to the entire body of the theory and practice of accounting.'

Following are the objectives of accountancy :

I. Record of financial transactions & events - The main objective of accountancy is to keep a systematic record of financial transactions or events according to specified rules. Complete record of business transactions helps to avoid the possibility of omission and fraud.

II. Determine profit or loss - The second main objective of accountancy is to ascertain the net profit or net loss (financial performance) of the business at the end of a financial year.

III. Determine Financial position - After ascertaining the net profit or loss, Balance sheet is prepared. The main purpose of Balance sheet is to ascertain the true & fair view of the financial position of the business at a particular point of time.

IV. Communicating accounting information to users : Another main objective of accountancy is to communicate accounting information to the various interested parties like owners, investors, creditors, bankers, govt. authorities, etc.

V. Assisting the Management - Another objective of accountancy is to assist the management by providing financial information. They need it for the efficient and smooth running of the business enterprise.

6. What is an Accounting Cycle ?

Ans : An accounting cycle is a complete sequence beginning with the recording of transactions and ending with the preparation of financial accounts.

The sequential steps involved in an accounting cycle are given below :

7. Explain advantages of accountancy.

Ans : Following are the advantages of accountancy :

I. Replacement of memory : Now-a-days, volume of transactions is so large, a human memory cannot absorb each & every transaction. So, Accounting helps to store the information in a systematic way.

II. Helpful in decision making : Accountancy helps in taking large number of decisions like amount to be withdrawn by proprietor, the selling price of the product, etc.

III. Facilitates control over assets : Accountancy facilitates control over assets by providing information regarding cash balance, bank balance, debtors, fixed assets, stock, etc.

IV. Helpful in planning : Information provided by the accounting data helps the management in forecasting future plans.

V. Facilities to ascertain financial performance : Accountancy facilitates to ascertain financial performance by preparing income statement of an accounting period.

VI. Information regarding financial position : Accountancy helps to ascertain the true & fair view of the financial position of the business by preparing balance sheet at the end of each accounting period.

LONG ANSWER TYPE QUESTIONS

1. What is Book keeping ? Explain its need.

Ans : same as (V.S.A - Q.No.1,2) & (S.A - Q.No. 3)

2. Define Book Keeping. Explain its process.

Ans: same as (V.S.A - Q.No. 2) & (S.A - Q.No. 2)

3. Explain the advantages of Book keeping.

Ans : Following are the advantages of Book keeping :

I. Data - Book keeping creates hard data which is used by the business owners to take useful decisions like expanding business, reducing costs etc.

II. Reduced tax liabilities - It helps in settlement of tax liabilities with the authorities by maintaining proper books of accounts according to tax rules & laws.

III. Minimize Errors - When a book keeper records all the transactions accurately then the possibility of errors is minimised.

IV. Performance of Enterprise - Book keeping helps the owner to know the financial position of the enterprise at the end of an accounting period.

4. What is meant by Accountancy ? Explain it's advantages.

Ans : same as (S.A - Q.No. 5 & 7)

5. Explain Accounting Cycle.

Ans : same as (S.A - Q.No. 6)

★★★★★

NBSE notes for Class 9 Book-keeping & Accountancy for all Chapters by NBSE Guide Online are provided here. Just click on the chapter wise links given below :

The above list comprises all the chapter-wise answers to the questions present in the NBSE book for Class 9 (Book-Keeping and Accountancy) in a very precise and lucid manner, maintaining the objective of textbooks.

*****

Comments

Post a Comment

If you have any doubts please let me know